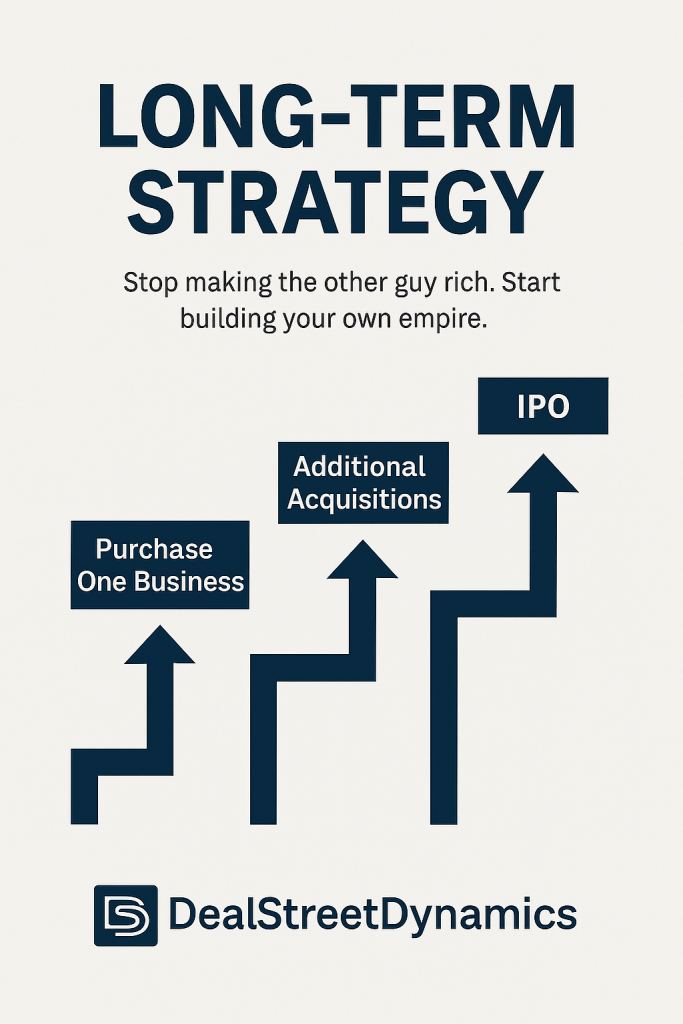

🚀 The Buyership Blueprint: From First Deal to Public Offering

“Stop making the other guy rich.

Start building your own empire.”

🥇 Phase 1: The First Acquisition

Escape the grind. Own the cash flow.

Most people spend their lives working for someone else’s dream. Buyership flips that script—empowering you to acquire a small business with real revenue, real customers, and real upside.

Target: Small, profitable business with $250K–$1M in annual revenue

Funding: SBA loan, seller financing, or creative deal structuring

Outcome: Replace your income, gain control, and build equity from day one

Mindset Shift: You’re no longer an employee—you’re the owner

“This isn’t a job change. It’s a life change.”

🧩 Phase 2: Strategic Roll-Ups

Stack deals. Multiply value. Move up-market.

Once you’ve stabilized your first acquisition, the next move is expansion. By acquiring complementary businesses, you increase scale, reduce risk, and unlock higher valuation multiples.

Target: Businesses in the same vertical or adjacent markets

Strategy: Consolidate operations, cross-sell customers, streamline costs

Valuation Impact: Mid-market businesses ($3M–$10M EBITDA) often trade at 2x–3x the multiple of smaller firms

Outcome: Build a portfolio that attracts institutional buyers and lenders

“Every deal adds leverage. Every inefficiency becomes an opportunity.”

💰 Phase 3: IPO or Strategic Exit

Go public. Get liquid. Leave a legacy.

With a strong portfolio and proven growth, you’re positioned for a major liquidity event. Whether it’s an IPO, SPAC, or strategic sale, this phase turns paper wealth into real capital.

Preparation: Audited financials, scalable infrastructure, investor-ready story

Valuation Drivers: Recurring revenue, brand equity, operational maturity

Outcome: Access to public markets, investor capital, and long-term wealth

Optionality: Retain control, exit partially, or reinvest in new ventures

“This isn’t just about money. It’s about freedom, credibility, and impact.”

🧠 WL’s Strategic Commentary

This isn’t theory. It’s a tactical roadmap for people who are done playing small.

Phase 1 is about escape velocity. You stop trading time for money and start owning the engine that prints it.

Phase 2 is where you compound credibility. Every acquisition isn’t just more revenue—it’s more leverage, more optionality, and a higher multiple.

Phase 3 is the liquidity event. IPO isn’t just about going public—it’s about going permanent. You build something that outlives the grind, outlasts the gatekeepers, and outperforms the noise.

Brokers sell listings. Buyership builds legacies. Most people chase jobs. You’re chasing leverage. Every obstacle is a signal. Every inefficiency is a gift. This is how you turn ownership into impact.

🚀 Ready to Flip the Script?

If you’re tired of gatekeepers, gimmicks, and listings that go nowhere—step into Buyership. We don’t chase deals. We architect leverage. We don’t wait for permission. We build systems that make the old model irrelevant.

→ Join the movement. → Scout smarter. → Acquire with confidence.

This isn’t brokerage. It’s business ownership, redefined.

| Product | Description | Price / Offer | Video Link | Buy Now |

|---|---|---|---|---|

| Business Acquisition Mastery | A clear step-by-step framework to locate, evaluate, and acquire real businesses—without overwhelm or jargon. | $997 One-time Payment | 📹 Watch on YouTube | 🛒 Buy Now |

| Built2Own Accelerator | Instruction + partnership. Navigate the acquisition process and build ownership with WL’s guidance and equity alignment. | $4,700 + 30% Equity Partnership | 📹 Watch on YouTube | 🛒 Apply Now |

| Real Hope Lifestyle | Resilience begins within. This mindset-focused program builds spiritual strength, emotional clarity, and purpose-driven habits. | $197 One-time Payment | 📹 Watch on YouTube | 🛒 Buy Now |