📊 DealStreetDynamics Financial Analysis Report

1. Historical Financials (3–5 Years)

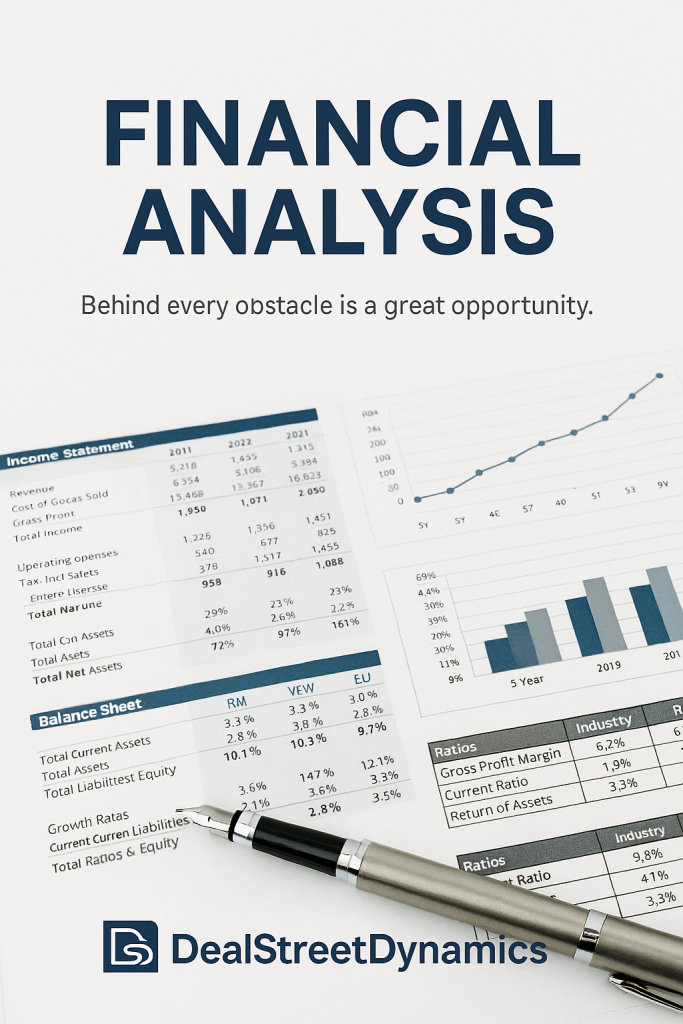

Income Statement, Balance Sheet, and Cash Flow

Year-over-year growth rates

EBITDA and discretionary earnings normalization

Visuals: trend charts, margin breakdowns, revenue mix

2. Industry Benchmarking

Compare key ratios to Robert Morris Associates (RMA) Financial Statement Studies:

Gross margin, net margin, current ratio, debt-to-equity, inventory turnover

Highlight overperformance and underperformance zones

Include percentile rankings and industry averages

3. Valuation Summary (Top 4 Methods)

| Method | Description | Value Range |

|---|---|---|

| Asset-Based | Net tangible assets adjusted for market value | $X–$Y |

| Income-Based (DCF) | Discounted future cash flows | $X–$Y |

| Market-Based | Comparable sales multiples (SDE, EBITDA) | $X–$Y |

| Rule of Thumb | Industry-specific heuristics | $X–$Y |